Credit One offers a wide range of pre qualify cards with a range of financial products that are worth grabbing for. Credit One Bank is based in Los Angeles, Nevada. It is an organization dedicated to the financial service with data-driven technology.

Excellent endeavor by Credit One

Credit One offers a wide spectrum of financially beneficiary products as well as the scope to use the products’ injudicious manner. Nonetheless, the security of the Credit One customers comes with the utmost importance. Your finance is secured with Credit One.

Credit one consists of more than 10,000 active card members and its always increasing. A statistics released in the year 209, shoes, Credit One has contributed to whooping $7, 500, 00 charitable endeavors. However, the main reason to celebrate Credit One is the generous cashback it is offering to every cardholder. A total of $86,000,000+ cashback rewards have been awarded to its customers till this date (and still counting!).

Credit One is giving you an open chance to become a part of their ever-growing family. And the way is very simple! Check the pre-approved offers, get your approval code, complete your application and finally get your dream account activated for good.

Why Credit One

Besides, there are several other reasons for opting Credit One Card account. Every member of the Credit One will enjoy perks like unlimited cash backs rewards, a monthly update of Experian credit score and much more happiness waiting to be unlocked!

- Compulsory and fixed cashback anytime on purchasing eligible goods.

- For any unauthorized charges, you are protected by the zero liability features.

- Nothing can make you happy than the increase in the credit line. What more, Credit one gives you regular updates and notification on an increase in credit line along with the tips to increase.

- Speaking of credit, Experian credit score will be sent to you every month along with the report of credit summary without any charge.

Credit One Pre Qualify For Credit Card:

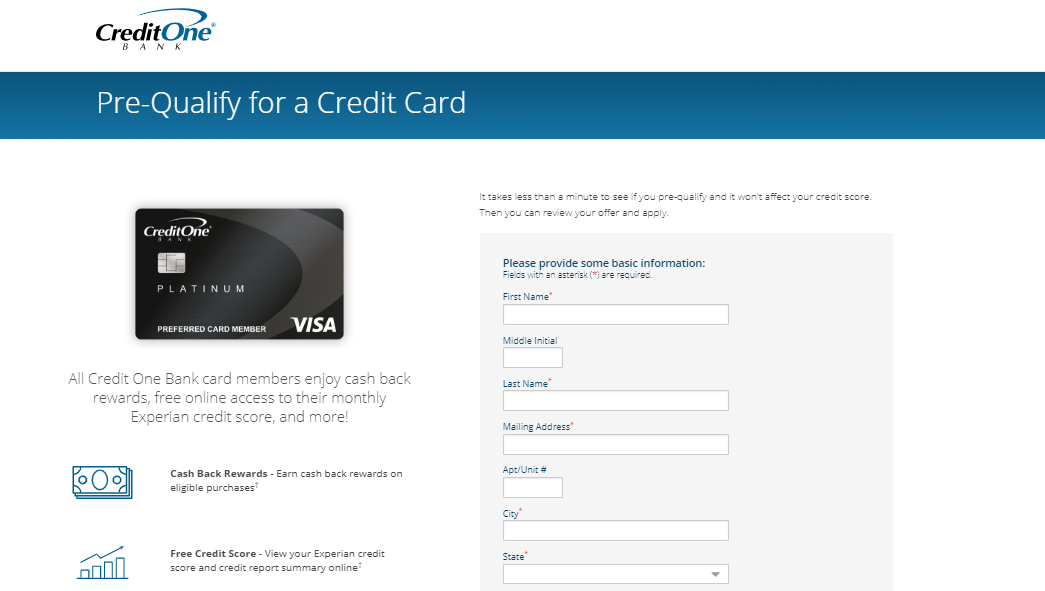

Time to get back to the application. As discussed above, the first thing to checklist is whether you pre-qualify for Credit One Card offers. You need to fill up a simple registration form stating all your details and check your eligibility. All of it will take just a few moments. So get started:

- Click on See If You Pre-Qualify

- Enter the mentioned information one by one:

- First Name.

- Middle Name’s Initial (optional).

- Last Name.

- Mailing Address.

- Apartment/Unit.

- Zip Code.

- Email Address.

- Primary Phone Number.

- Social Security Number.

- Date of Birth (mm-dd-yyyy).

- Total Monthly Income

- Before proceeding, please check the terms and conditions

- Click on See Card Offers.

Please go through all your card offers displayed carefully. Choose the one. In case, you do not pre-qualify, you will get tips to improve your credit line or the eligibility criteria which can make you consider for qualification.

What if you haven’t got Approval Code

Following the prompts, after checking pre-approval will result in Credit One sending you the unique Approval Code in your email address. However, since the information you have entered will be reviewed thoroughly during pre-qualification, it may take time to send the applicant their respective approval code. In such a scenario, if the people still haven’t received Approval Code after following every step for pre-qualification, they must refer here for proper guidance:

- Click on Don’t have your Approval Code?

- Enter: First Name > Middle Name Initials > Last Name and

- Applicant’s Social Security Number(only the last four digit)

- Click on Search Now.

- Check the status of your qualifications. If it is approved, you will promptly be provided with the Approval Code.

Apply Credit One Pre-Approved Credit Card:

It must be noted that the Approval Code does not act like the real deal! That means, the Approval Code increases your chance to get your Credit One Card activated and brings one step closer to it. After obtaining the Approval Code, you still require to go through the application procedure properly. Begin your application by:

- Refer to the email you had received and enter the Approval Code accurately as it is mentioned.

- Type your Social Security Number.

- Click on the Continue tab to proceed with the long process of application.

Keep all the credentials for the application with you. Strictly follow the procedure to successfully complete the application.

Credit One Card Application Status

Post application, you need to check the status of your application from time to time to know the status. This way, you can keep track of your chances. And it’s super easy to verify the status:

- Open www.creditonebank.com/application-status

- Enter the Last Name of the applicant written exactly at the time of application.

- Type the individual’s Social Security Number.

- Click on Check Status.

Read More: How To Access PayPower Prepaid MasterCard Account

Customer Care:

Credit One Bank has a classified system of handling customer queries and concerns with separate departments looking after specific concerns. Since here you learned about application procedures, so you need to connect with the Application Information Department to connect with the relevant channel.

Phone:

Dial 1-800-752-5493.

Time:

Monday To Friday: 5:00 a.m. – 9:00 p.m. (All Times Pacific)

Saturday & Sunday: 6:30 a.m.-5:00 p.m. (All Times Pacific)

Mail (General Correspondence)

Credit One Bank

P.O. Box 98873

Las Vegas, NV 89193-8873.

References:

www.creditonebank.com/pre-qualification

creditonebank.com/pre-approved